Make 2x the Impact Now

Make 2x the Impact Now

Our March Mission Match is underway, but not for long. Your gift by March 10 can go twice as far to advance research and help provide care and support for those living with Alzheimer’s and their caregivers.

Give NowGift Options to Meet Your Goals

There are many ways you can plan for the financial security of your loved ones and make a significant contribution in the fight against Alzheimer’s and all other dementia.

Contact us

Our Planned Giving Staff can answer your questions and help you learn more about the different ways you could give to the Alzheimer's Association.

There are numerous types of planned gifts that generally fall into one of three categories: Gifts in your will or living trust, gifts that produce income and simple ways to give through beneficiary designations.

Gifts that cost you nothing today

Beneficiary designation

One way to make a lasting difference is to name the Alzheimer’s Association as the beneficiary of a financial or retirement account. You can complete this gift on your own at any time. You can name the Alzheimer’s Association as the beneficiary of any of these accounts:

- Individual retirement accounts

- Life insurance policies

- Bank or brokerage accounts

- Certificates of deposit

- Donor advised funds

Learn more about beneficiary designations.

The information provided here is presented solely as general educational information and is not intended to be a substitute for professional estate planning or legal advice.

Gift in your will or trust

Creating a will or trust is a smart way to provide for your loved ones and the causes you care about. A gift in your will, also known as a charitable bequest, allows you to make a significant impact in the fight against Alzheimer’s while retaining control of your funds during your lifetime.

How you benefit:

- You can provide for your loved ones and the causes you care about.

- You may leave a gift of any amount; there is no minimum gift size.

- You can name your gift in honor of a loved one.

- You are never locked in — you can change your mind if your circumstances change.

- You are welcomed into our Founders Society.

Learn more about leaving a gift in your will or trust.

Sample Language for a Gift in Your Will or Trust

I give to the Alzheimer's Disease and Related Disorders Association, Inc. (doing business as the Alzheimer's Association), currently located at 225 North Michigan Avenue, 17th Floor, Chicago, IL 60601_______________(insert specific dollar amount or percentage) in support of its full mission. Federal tax identification number: 13-3039601.

The information provided here is presented solely as general educational information and is not intended to be a substitute for professional estate planning or legal advice.

Gifts from your retirement account

Donate from your retirement account now

You may be eligible to make a gift directly from your individual retirement account (IRA) and enjoy significant tax savings. A qualified charitable distribution (QCD), also called an IRA charitable rollover, allows your donation to make a difference right away.

If you are 70 ½ or older, you can give up to $108,000 per year from your IRA directly to the Alzheimer’s Association without having to pay incomes taxes on the money. And your gift may qualify for your required minimum distribution.

Give to the Alzheimer’s Association through IRA

Provide the following information to the institution that manages your IRA:

Alzheimer’s Association

Attn: Donor Services

225 North Michigan Ave.

Floor 17

Chicago, IL 60601-7633

Tax ID#: 13-3039601

Learn more about donating from your retirement account.

Before proceeding, please consult your tax advisor to discuss your particular situation including the possible impact of your state's tax laws.

The information provided here is presented solely as general educational information and is not intended to be a substitute for professional estate planning or legal advice.

Leaving a gift of retirement assets to the Alzheimer’s Association is a tax-wise way to help end Alzheimer’s and all other dementia. Retirement plan assets, if transferred to someone other than a spouse, are one of the most heavily taxed of all assets. That’s why many people choose to donate retirement assets to the Association while leaving other less tax-burdened assets to their heirs.

How you benefit:

- Increase the value of your estate for your heirs.

- Because we are a tax-exempt nonprofit, 100 percent of your gift supports the Alzheimer’s Association.

- You are welcomed into our Founders Society.

Learn more about leaving a future gift from your retirement account.

The information provided here is presented solely as general educational information and is not intended to be a substitute for professional estate planning or legal advice.

Gifts that provide income

You can make a lasting difference with a gift that provides you or your loved ones with income in return.

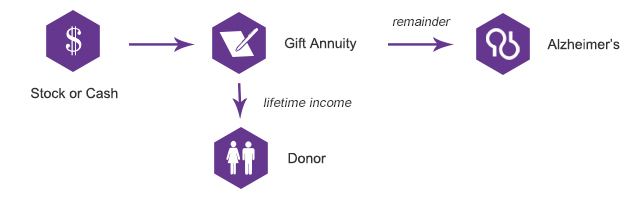

Charitable gift annuity

A charitable gifts annuity is a good option if you would like to make a gift that provides you with steady income for life. In exchange for a gift of cash or securities of $10,000 or more, the Alzheimer’s Association will pay you a fixed dollar amount each year for as long as you live.

- You may establish a gift annuity to benefit one or two people.

- You or your beneficiaries receive guaranteed, fixed payments for life.

- You may enjoy capital gains tax savings if you transfer appreciated securities to fund your charitable gift annuity.

- You receive a charitable deduction in the year you create the annuity, if you itemize your deductions.

- You are welcomed into our Founders Society.

Learn more about charitable gift annuities.

The information provided here is presented solely as general educational information and is not intended to be a substitute for professional estate planning or legal advice.

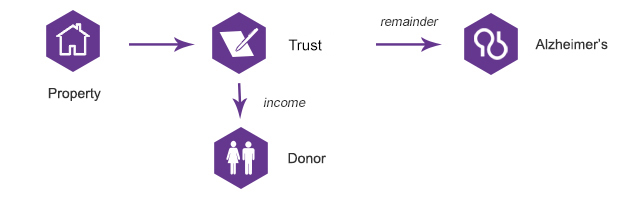

Charitable remainder trust

A charitable remainder trust is an excellent choice if you want to create tax savings now and earn income over time.

A charitable remainder trust is a legal document that allows you to transfer assets into a trust account and invest them for a period of time. The trust pays you and/or your beneficiaries annually. At the end of the trust term, the money remaining in the trust is distributed to the Alzheimer’s Association.

How you benefit:

- You receive an income tax deduction in the year you create the trust.

- You may choose a trust that pays you a fixed dollar amount each year or one that pays a percentage of the trust’s value.

- If you create the trust with a gift of appreciated stock or property, you may avoid capital gains tax.

- You are welcomed into our Founders Society.

Learn more about charitable remainder trusts.

The information provided here is presented solely as general educational information and is not intended to be a substitute for professional estate planning or legal advice.

Gifts that provide solutions

A charitable lead trust is a good choice if you want to see the impact of your giving right away and provide for your family in the future.

With a charitable lead trust, you transfer assets to the trust. The trustee makes payments to the Alzheimer’s Association for a set number of years. At the end of that time frame, the trust assets are transferred to you or to your heirs.

How you benefit:

- You receive a charitable tax deduction.

- You, or your heirs, receive the appreciation in the trust assets at the end of the trust term.

- The annual income from your trust supports the fight against Alzheimer’s and all other dementia.

- If transferred to your loved ones, the assets are not subject to estate and gift taxes.

- You are welcomed into our Founders Society.

Learn more about charitable lead trusts.

The information provided here is presented solely as general educational information and is not intended to be a substitute for professional estate planning or legal advice.

The first survivor of Alzheimer's is out there, but we won't get there without you.

Donate Now

Learn how Alzheimer’s disease affects the brain.

Take the Brain Tour